Ajit Pawar Corruption Cases List – Full Timeline, Allegations, and Current Status

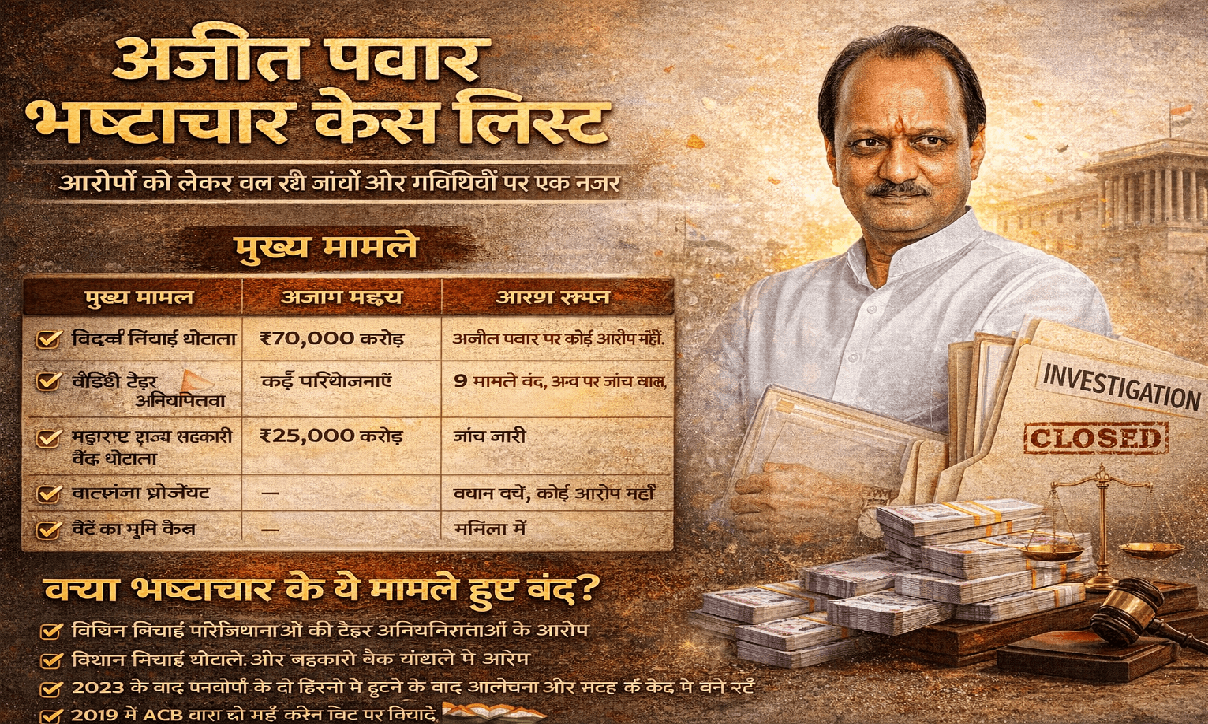

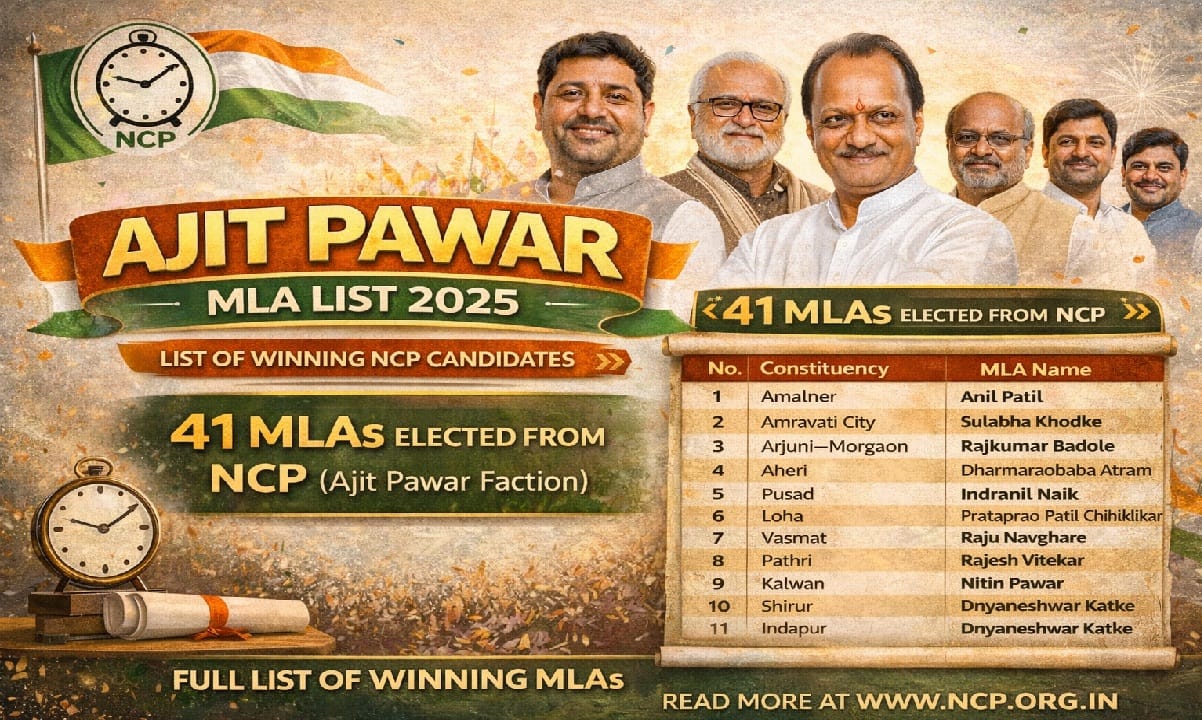

Ajit Pawar, a senior leader of the Nationalist Congress Party (NCP) and a multiple-time Deputy Chief Minister of Maharashtra, has often been at the centre of political controversy. Over the years, several corruption allegations and investigations have been linked to his name, especially during his tenure as the Water Resources Minister and later as a powerful figure in Maharashtra politics. Highlights of Ajit Pawar Corruption Cases Case / Issue Alleged Amount Agency Involved Current Status Vidarbha Irrigation Scam ₹70,000 crore (claimed) ACB No charges against Ajit Pawar VIDC Tender Irregularities Multiple projects ACB 9 cases closed, others under probe MSCB Scam ₹25,000 crore ED, Mumbai Police Investigation ongoing Balganga Project — ACB Statement recorded, no charges Son’s Land Case — State agencies Under review Why Ajit Pawar Faced Corruption Allegations Ajit Pawar rose rapidly in Maharashtra politics under the guidance of his uncle Sharad Pawar. His control over key departments, especially irrigation and finance, brought both influence and scrutiny. Most allegations against him emerged between 2010 and 2019, mainly related to: Irrigation projects in Vidarbha Cooperative bank loan irregularities Tender manipulation claims Irrigation Scam Allegations (₹70,000 Crore Claim) One of the most talked-about controversies involving Ajit Pawar was the Vidarbha Irrigation Scam, alleged to be worth nearly ₹70,000 crore. Key points The allegations related to irrigation projects executed by the Vidarbha Irrigation Development Corporation (VIDC). BJP leaders, including Devendra Fadnavis, accused the NCP government of massive irregularities. Ajit Pawar was then the Water Resources Minister. ACB Investigation Outcome: Maharashtra Anti-Corruption Bureau (ACB) examined 45 projects and 2,656 tenders. FIRs were registered in 24 cases against contractors and officials. Nine inquiries were closed, as no irregularities were found. ACB officially stated Ajit Pawar was not named in those nine closed cases. Ajit Pawar resigned as Deputy CM in 2012 due to political pressure but later returned after no direct charges were proven. Maharashtra State Cooperative Bank (MSCB) Scam Another major controversy linked to Ajit Pawar is the MSCB Scam, estimated at around ₹25,000 crore. Case details: Alleged irregularities in loans given to sugar mills. FIR registered by Mumbai Police. Enforcement Directorate (ED) later registered a money laundering case. Ajit Pawar and Sharad Pawar were named in the FIR. Status: Investigations are ongoing. No conviction has been recorded against Ajit Pawar so far. The matter remains legally sub judice. ACB Closure of Nine Cases After Ajit Pawar Joined BJP Alliance Soon after Ajit Pawar joined hands with the BJP and became Deputy CM, the ACB closed nine irrigation-related inquiries, leading to strong political reactions. What ACB clarified Ajit Pawar’s name did not appear in those nine cases. No irregularities were found. Closures were termed routine administrative decisions. Political reaction: Congress accused BJP and ACB of “misusing institutions”. Congress leaders called it a “contract killing of accountability”. NCP leaders supporting Ajit Pawar said the closure proved allegations were false. Other Allegations and Controversies Ajit Pawar’s statement was recorded in the Balganga Irrigation Project inquiry (2015). Criminal cases were filed against contractors, not Ajit Pawar. His son Parth Pawar has also faced allegations in a separate Pune land deal, which is under scrutiny. Political Impact on Ajit Pawar’s Career Despite repeated allegations: Ajit Pawar became Deputy Chief Minister five times. He won the Baramati Assembly seat eight consecutive times. Regained political strength after the NCP split in 2023. Received a clean chit from the ACB in 2019. Read : Ajit Pawar MLA List