Sankashti Chaturthi Dates 2026 List – Month-Wise Tithi, Time & Vrat Details

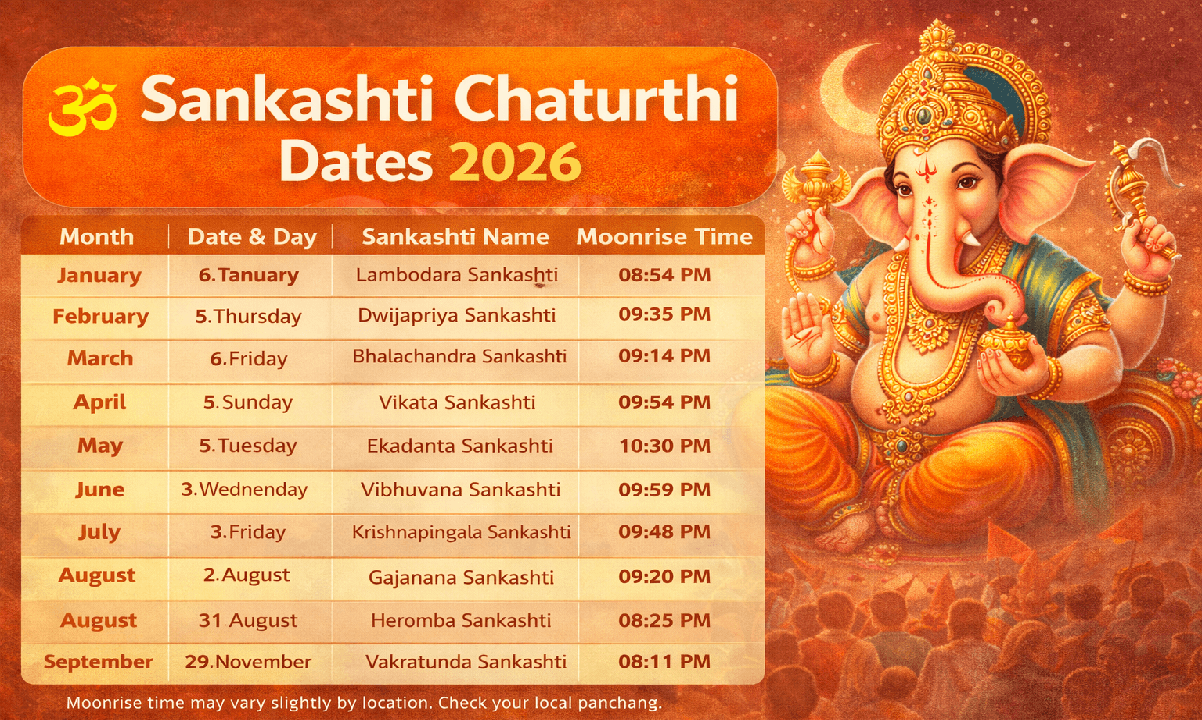

Sankashti Chaturthi is one of the most important fasting days dedicated to Lord Ganesha. It is observed every month on the Krishna Paksha Chaturthi (4th day after Full Moon). Devotees believe that observing Sankashti Chaturthi vrat with devotion removes obstacles, brings peace, prosperity, and fulfils wishes. What is Sankashti Chaturthi? The word “Sankashti” means deliverance from troubles. On this day, devotees observe a strict fast from sunrise till moonrise and then break the fast after offering prayers to Lord Ganesha. Each Sankashti Chaturthi is associated with a different form of Lord Ganesha, and listening to the Vrat Katha on this day is considered very auspicious. Sankashti Chaturthi Dates 2026 – Month-Wise List Below is the complete Sankashti Chaturthi dates 2026 list with Ganesh names and moonrise timings. Month Date & Day Sankashti Name Moonrise Time January 6 January, Tuesday Lambodara Sankashti (Sakat Chauth) 08:54 PM February 5 February, Thursday Dwijapriya Sankashti 09:35 PM March 6 March, Friday Bhalachandra Sankashti 09:14 PM April 5 April, Sunday Vikata Sankashti 09:54 PM May 5 May, Tuesday Ekadanta Sankashti 10:30 PM June 3 June, Wednesday Vibhuvana Sankashti 09:59 PM July 3 July, Friday Krishnapingala Sankashti 09:48 PM August 2 August, Sunday Gajanana Sankashti 09:20 PM August 31 August, Monday Heramba Sankashti 08:25 PM September 29 September, Tuesday Vighnaraja Sankashti 07:39 PM October 29 October, Thursday Vakratunda Sankashti 08:11 PM November 27 November, Friday Ganadhipa Sankashti 08:12 PM December 26 December, Saturday Akhuratha Sankashti 08:13 PM Read: Arupadai Veedu List Sankashti Chaturthi Vrat Rules Wake up early and take a bath Observe nirjala vrat (without food) or phalahar vrat Worship Lord Ganesha with flowers, durva grass, and modak Read or listen to Sankashti Chaturthi Vrat Katha Break the fast only after moonrise Highlights of Sankashti Chaturthi 2026 Feature Details Festival Name Sankashti Chaturthi Year 2026 Calendar Hindu Lunar Calendar Tithi Krishna Paksha Chaturthi Deity Lord Ganesha Fasting Break After Moonrise Total Sankashti in 2026 13 Special Sankashti Sakat Chauth (January) Read: 12 Jyotirlinga Names